Wall Street's Love Affair with the "Taco Trade" Faces a Real Test

By David Nelson, CFA

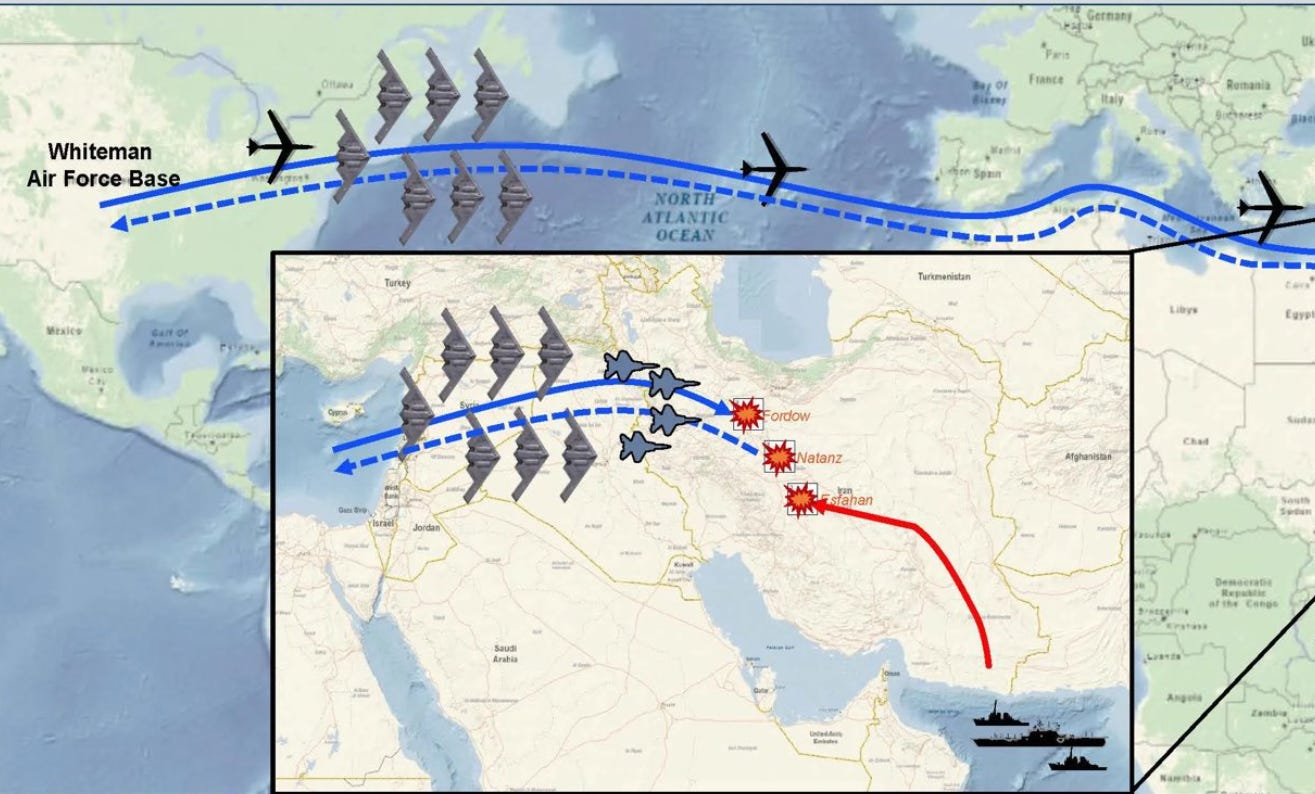

Traders clinging to the hope that the TACO trade will once again hold true should remember that just weeks ago, Trump followed through on a very different kind of threat. In response to intelligence that Iran was moving closer to a nuclear breakout, the president ordered a military strike. B-2 bombers were deployed on a round-trip journey half a world away, dropping 14 bunker-buster bombs on three Iranian nuclear facilities. All in, 125 aircraft were used along with submarine launches of two dozen cruise missiles.

Doesn't look like he chickened out, does it?

DOD

There’s a long-standing axiom in markets: uncertainty is worse than bad news. Since President Trump’s April 2 "Liberation Day" announcement of sweeping tariffs—a 10% baseline on nearly all imports and threats up to 50% on some countries—investors have been watching warily, unsure whether they’re witnessing another negotiating tactic or the foundation of a new global trade architecture. With a new round of 30% tariffs announced Saturday, now aimed at the European Union and Mexico, the recent calm in financial markets is about to face another test.

V-Shaped Recovery

Bloomberg Data

Back in April, the S&P 500 fell sharply, losing over 12% in just four trading days after the Liberation Day tariff announcement blindsided investors. Bond markets also reacted violently. Ten-year Treasury yields cratered from 4.3% to below 3.9% in a matter of days, signaling deep concern in the financial plumbing and raising red flags about systemic stress.

Bloomberg Data

It was this disruption, not just in equities but across the broader asset landscape that likely prompted the White House to pause. Sources close to the administration say Treasury Secretary Scott Bessent played a key role in advising President Trump to delay implementation so negotiations could unfold. Capital markets, particularly the bond market, had spoken—and Washington listened.

What followed was one of the biggest V-shaped recoveries I’ve seen in my career. From the intraday lows of April to the recent all-time highs the S&P 500 jumped close to 30%. The tariff pause was certainly at the heart of the explosive move higher but adding fuel to the trade was stronger than expected Q2 earnings and a renewed belief that the AI trade is alive and well.

Add a backdrop of cooling inflation and a resilient job market the pain trade was higher. Traders were dragged into the market kicking and screaming with many market professionals concerned stocks were too expensive.

Fast-forward to July, and the White House has doubled down, threatening 30% blanket tariffs on two of America’s largest trading partners: Mexico and the European Union. Leading up to Saturday's announcement markets are close to the highs with the VIX hovering near lows, masking any sign of fear building up on trading desks. So, what gives?

Taco Bravado

Bloomberg Data

Part of the answer lies in what some on Wall Street now call the "TACO" doctrine—short for "Trump Always Chickens Out."

Truth Social

There’s still a belief among traders and portfolio managers that the administration’s opening gambits are more about creating leverage than final policy. That belief has, so far, proven profitable. But the Iran strike is a reminder: when the stakes are high enough, this White House may act decisively—even if markets expect otherwise.

The Difference Between 10% & 30%

The recovery off the April lows was in part driven by stock investors who believed that in the end tariffs would end up between 10 -15%. Goldman estimates hover on the upper end of that spectrum.

At 10% companies can leave existing supply chains and manufacturing intact. Consumers would likely take on about half the burden on higher costs with companies willing to sacrifice margins and eat the rest of the increase. The battle for market share still exists and few have the pricing power needed to fight that dynamic.

But at 30% a CEO has to completely rethink their playbook. Many firms would be forced to upend those existing supply chains with a complete overhaul of their manufacturing footprint. Even Apple has gotten the message moving some of their manufacturing from China to India.

In Europe, the response has been mixed. French President Emmanuel Macron has urged the EU to prepare for a trade war, while German and Italian leaders have called for a more pragmatic response.

Without a deal in place the economic pain may not be immediate but will be felt throughout the industrial complex.

Why Markets Have Shrugged

Several factors help explain the resilience of equity markets despite the escalating rhetoric:

Tariff fatigue: After years of trade headlines, markets have grown desensitized. Every threat is met with the expectation of eventual retreat.

Strong earnings: Q2 results broadly beat expectations with traders looking for a repeat this quarter.

Macro resilience: Inflation is cooling, employment remains robust, and the Fed has room to cut if needed.

AI optimism: The AI trade continues to power mega-cap tech and broader market confidence, suggesting a new potential growth engine.

Negotiation precedent: Previous threats have often led to revised deals rather than full-blown trade wars.

The threats are priced, but the execution isn’t. If actual tariffs go into effect at 30%, the re-rating will be swift.

Trump's Tariff Doctrine: Then and Now

Verdict - This is more than just a repeat of first-term tariff policy. The administration has clearly shifted from using tariffs as a tactical weapon to a strategic pillar of a broader industrial and trade policy reset. It’s not just about pressuring China or enforcing NAFTA clauses—it’s about redrawing the map of global production.

The Historical Context: From Bretton Woods to Today

To understand the magnitude of what’s unfolding, we need to revisit the foundations of the postwar trading system. The Bretton Woods Agreement of 1944 was forged in the wake of World War II. The United States, emerging as the world's dominant economic power, accepted a global system that was in many ways tilted against it. Higher foreign tariffs were tolerated to help Europe and Asia rebuild.

That compromise made sense at the time. But as I argued in a previous Money Runner article titled “A New Bretton Woods?”, the world has changed. The same nations once aided by American generosity now impose steeper tariffs on U.S. goods than we do on theirs. The administration is right to question that status quo—and perhaps even to disrupt it.

While tariffs are blunt instruments, they can be useful when used with clear objectives. If the endgame is a broader negotiation—one that forces global stakeholders back to the table—then today's discomfort may be the cost of tomorrow's structural reform.

Conclusion: A Delicate Balance with a Bigger Goal?

The August 1 deadline looms large. The administration has sent letters to 24 countries and counting. So far, only the U.K. and Vietnam have struck preliminary deals. Without broader resolutions, hundreds of billions in trade could be impacted.

Moreover, this time feels more ideological. In his public remarks, Trump has moved beyond transactional grievances. He speaks of reshaping the global trading order, rewarding onshoring and punishing globalized supply chains.

For now, the market’s patience holds—but barely. Professionals are hedging with defensives and commodities, while hoping that pragmatism prevails over ideology.

But perhaps this moment demands a bigger conversation. One not just about tariffs, but about the structure of global trade itself. A new Bretton Woods-style framework—updated for the complexities of AI, digital trade, and modern supply chains—may be the real goal.

If that’s the case, then today's tension may be laying the groundwork for a system that’s not only more balanced, but more durable.

Tariffs may start as a headline, but the conversation could redefine the world economy.

David Nelson, CFA, is the Chief Strategist at Belpointe Asset Management and host of The Money Runner Podcast. He appears regularly on Fox Business, Yahoo! Finance, and other financial media.