The Front Lines are Everywhere: From Donetsk to the Nasdaq

By David Nelson, CFA

Heading into the Trump-Putin summit in Alaska, expectations ran high. Markets rallied, pundits floated cease-fire scenarios, and geopolitical optimists imagined a frozen conflict giving way to a negotiated peace. That narrative evaporated almost as fast as it formed.

President Trump’s openness to offering U.S. security guarantees to Ukraine was a meaningful shift in tone. Still unconfirmed the Wall Street Journal is sourcing that statement from European Leaders. Ukrainian President Volodymyr Zelensky swiftly rejected a key tenet of the proposal, surrendering currently held portions of Donetsk Oblast to freeze the line elsewhere.

Meanwhile, Putin doubled down on broader demands, insisting that the root causes of the conflict, NATO expansion and Ukraine’s Western trajectory be addressed in full.

If the market was hoping for a clean geopolitical resolution, Friday wasn’t it. This was always going to be messy. The ongoing war is 1272 days and still running. The cost on both sides is measured in blood, territory and money.

But beyond the headlines and handshakes, the deeper concern for investors is the growing sense that this war may become a fixture of the global landscape. That possibility brings with it persistent risks: elevated defense spending and structural energy market volatility. Markets can absorb shocks, but struggle with conflicts that drag on without a visible endgame.

Uncertainty should be the watch word for the coming days of negotiations and political maneuvering. Trump has proven he can catch leaders and the electorate completely off guard.

Let’s not forget that just weeks ago we woke up to B2 bombers dropping precision guided bunker buster bombs half a world away. It doesn’t have to be military power that is brought to bear. It could easily be financial sanctions that even the most powerful countries would find difficult to navigate. The problem with sanctions is that their impact is measured in quarters, not news cycles, an uncomfortable reality in an era when markets and media demand instant resolution.

From Firefights to Fed Funds: Dual Fulcrums of Market Sentiment

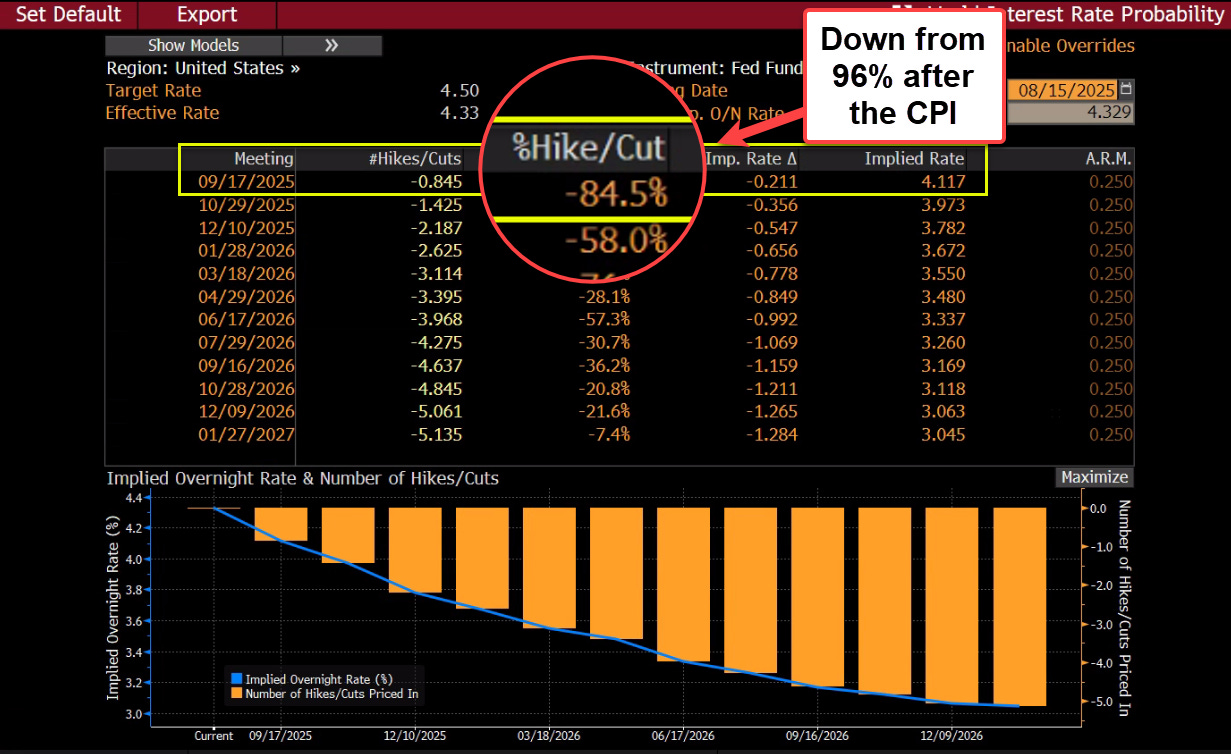

Bloomberg Data

The Federal Reserve and artificial intelligence have become twin fulcrums upon which market sentiment pivots. The Fed remains the primary lever of macro liquidity. For a brief moment last week, it looked like the doves had regained control. Traders priced in a 96% chance of a September cut. But those odds have since retreated to 84% as last Thursday’s Producer Price Index (PPI) came in hot—up 0.9% month-over-month versus a 0.2% consensus estimate.

Bloomberg Data

The probability of a 50-basis-point cut has dropped sharply as well, alongside a more modest outlook for total rate cuts in 2025.

J.P. Morgan notes that while the "Fed put" still underpins risk assets, the path to Goldilocks is narrow. Labor market data is weakening, the inflation outlook is complicated by tariffs, and valuations are stretched. Their base case avoids recession, but they stress the need for macro hedges given the rising fragility in the economic data.

As for AI, the bullish thesis remains captivating but incomplete. Bulls often fail to account for the looming bottleneck in energy. The trajectory of investment in power infrastructure and the electric grid is nowhere near what's required to sustain the exponential compute demands of AI applications.

Chat GPT 5 gets a thumbs down from many users

Adobe

Even within OpenAI, signs of energy constraint are becoming evident. ChatGPT-5 in part may have been created to reduce processing demands in hopes of easing the cost curve and improving margins.

The disappointment over the latest release from Sam Altman and company was huge with many including yours truly demanding a solution to switch back to 4o. It took a while but management capitulated and put back 4o as an alternative to the current model. There are so many things I dislike about Chat 5 I'm going to have to dedicate a full podcast to cover it all. But here are just a few of my pet peeves.

Even if you switch back to 4o you lose all of your organizational structure. You can no longer create a project where 4o is the default engine in a project

When you prompt in a chat several tasks to be completed, Chat 5 ignores many of the commands. If you ask for 5 items it might give you 3 hoping you won't notice their attempt to save on compute time

Apparently Chat 5 is sifting through several models in search of a balance between cost saving and output. It isn't working

4o was more human like. Great for creative artists. It seemed to learn your style. A useful tool if your looking for an interactive agent to work on fresh ideas,

I could continue but lets get back to the task at hand.

US Future Power Curve vs AI Demand DOES NOT Compute

Adobe

If AI is going to be the investment theme of a lifetime, the return on investment must be high enough to encourage ongoing capital deployment. That won’t happen without solving the energy equation.

Eventually, an all-of-the-above approach will be necessary, with increased emphasis on future energy sources like nuclear, and perhaps someday something even more advanced to feed our insatiable appetite for power.

Earnings Shock: The Beat Nobody Priced In

Bloomberg Data

Corporate America delivered. With 92% of the S&P 500 having reported, earnings per share (EPS) rose 11% year-over-year in Q2, handily beating the 4% estimate heading into earnings season.

That's the good news. The bad news is that Earnings and Free Cash Flow Yields may not be enough to justify current stock prices. EPS growth will have to meaningfully pick up to keep valuations from deteriorating further.

Margins held up. Goldman’s David Kostin in his most recent note said S&P 500 margins remain roughly flat in the second half of this year. Management calls project dramatic expansion in 2026 an expectation Mr. Kostin finds unrealistic. I’ll defer to David believing it is still too early to expect AI to deliver some of the grandiose margin increases called for by the most bullish forecasts.

Final Thought: Fragility Beneath the Rally

Markets are celebrating a soft landing that hasn’t happened yet, peace talks that haven’t yielded results, and a Fed pivot that may be smaller and slower than what is priced in.

From the trenches in Donetsk to the boardrooms of Menlo Park, the world is changing fast. Investors need to stay agile, skeptical, and above all, data-dependent.

David Nelson is the Chief Strategist of Belpointe Asset Management and the host of The Money Runner Podcast.

You can find all of David's posts on his substack site dcnelson123@substack.com

Disclosure: "At the time of this article I currently hold shares in some of the companies mentioned as part of investment portfolios in funds I manage for Belpointe. Additionally, I may discuss other securities that are under consideration for future investment; however, discussing these securities is not a recommendation to buy, sell, or hold. My mention of these securities reflects my personal opinion and analysis at this moment and may change without notice. Please remember that all investments involve risks, including the possible loss of principal."