Garbage In, Trillions Out: How Flawed Data Threatens the Fed and Your Portfolio

By David Nelson, CFA

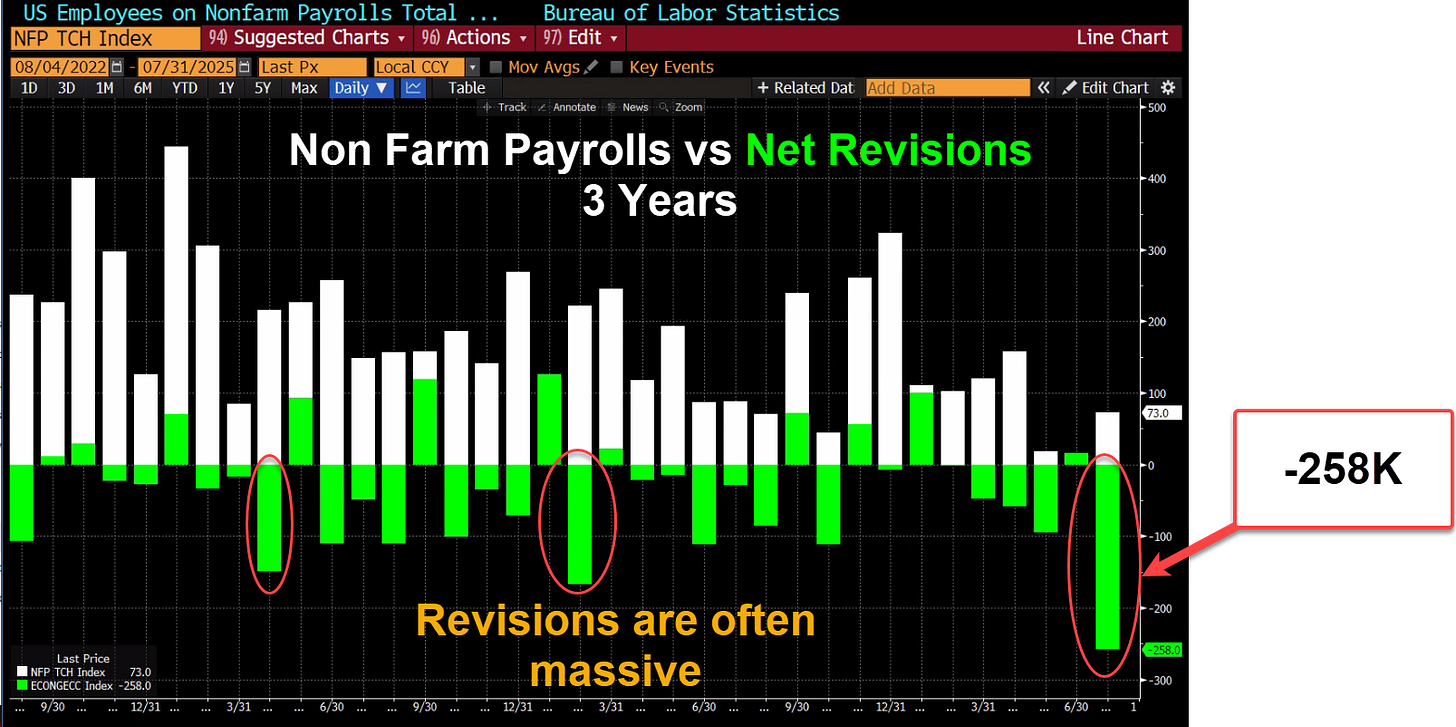

Markets were already wobbling after a worse-than-expected jobs report Friday. Payroll growth clocked in at just 73,000, well below consensus, and then came the gut punch: a 258,000-job downward revision across the prior two months. Bond yields collapsed as traders priced in a September Fed cut. But that wasn’t the story that set the world on fire.

Bloomberg Data

Within hours, President Trump fired Bureau of Labor Statistics Commissioner Erika McEntarfer, claiming the numbers were “RIGGED” to make Republicans and him look bad.

The political fallout was instant. Some saw a president shooting the messenger and politicizing an important government institution. Others called it overdue accountability for a bloated government agency too reliant on outdated methods.

But beyond the drama lies a critical truth: the BLS has a data integrity problem and it’s threatening the foundation of U.S. monetary policy.

Even absent political pressure, revisions of this magnitude, thousands of jobs on a near-monthly basis should be unacceptable in 2025. In an era where businesses deploy real-time data to guide decisions, the BLS still leans on surveys where response rates continue to fall and models designed decades ago.

There have been numerous studies by several think tanks and agencies regarding the BLS procedures, data collection methods and releases. According to Bloomberg the Labor Department, which oversees the BLS, ordered an independent review in 2024 to examine procedures and practices for the equitable and timely provision of data to the public.

Even fired commissioner Erik McEntarfer understands the need for the BLS to modernize and improve responding to the findings of a 2024 Labor Department Report. “We have already begun the work of turning the team’s recommendations into a roadmap to recommit our agency to data security and equitable access to data,” BLS Commissioner Erika McEntarfer said on a call.

But if Powell and the Fed are making trillion-dollar decisions based on data that may require a massive adjustment, what hope do investors have of navigating the fog?

MAG 7 Year to Date

Bloomberg Data

While Washington descended into chaos, Wall Street’s biggest names delivered this quarter. Four of the Magnificent 7 reported this week. META and MSFT results were cheered but reactions to Amazon and Apple were less than positive as both stocks ended lower on the day. Goldman's David Kostin in a note this week points out the group grew earnings by +26% YoY, compared to just +4% for the rest of the S&P 500.

Meta, Alphabet, and Microsoft didn’t just beat expectations, they reaffirmed their AI commitments despite ROI questions. Even Apple surprised to the upside with strength in both iPhones and services. Analysts responded with price target hikes across the board despite the fact Tim Cook and company still have not articulated a clear message on how they will maintain their competitive edge in an AI centric landscape.

Tesla? Still a story in search of a script.

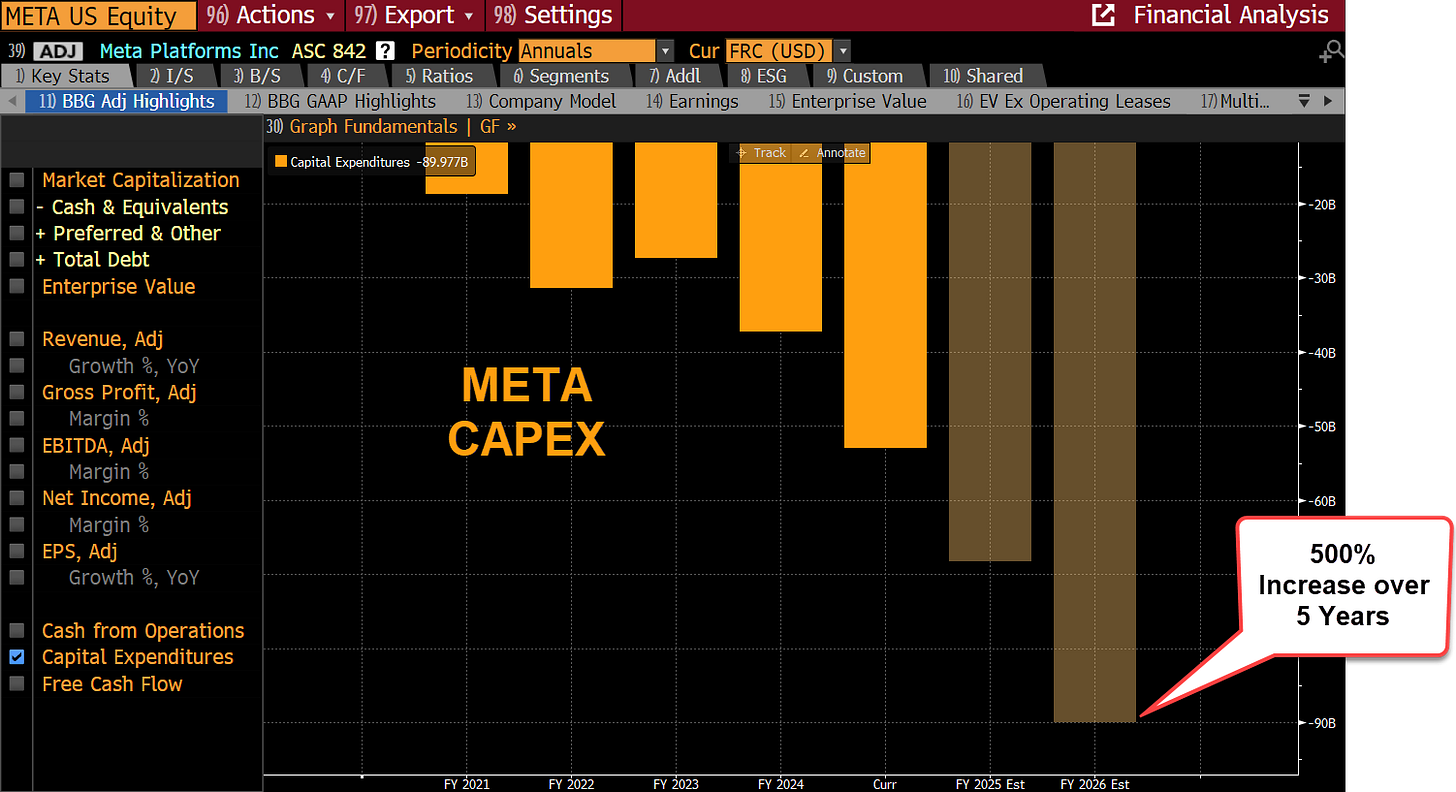

Amazon’s AWS margins sparked concern. Some analysts question their leadership in the Gen AI race. The spending by the group is staggering and accelerating.

Now all eyes turn to Jensen Huang's NVidia to find out if the largest company on the planet can maintain its lead in an industry that has seen other great leaders fail. There was once a time when consumers only wanted computers with the famous Intel Inside sticker.

CapEX Accelerating

Bloomberg Data

When you line up CapEx charts from the hyperscalers, it looks less like investment and more like survival. Compute and energy demands are unlike anything in history. We’re still in the early innings, but this arms race is already reshaping capital markets, supply chains, and even geopolitics.

Tariffs Still the Wild Card

Bloomberg Data

Markets have priced in a lot of good news but with tariffs still unresolved, the risk of episodic selloffs remains high. Outside days like the one we saw Thursday often trigger a knee jerk reaction to the downside as investors look for any catalyst to lock in returns.

Yes, deals with the EU, Japan, UK, South Korea, and Vietnam are inked. But China, Mexico, Canada, and India—some of our largest trading partners are still in limbo. Negotiations remain fluid. Every headline threatens to blow up the script.

Earlier this year I said the tariff picture wouldn’t be fully formed until year’s end. That still holds. But the closer we get, the more market volatility we’ll see, especially in multinational equities and dollar-sensitive assets.

Even the Fed is Fracturing

Bloomberg Data

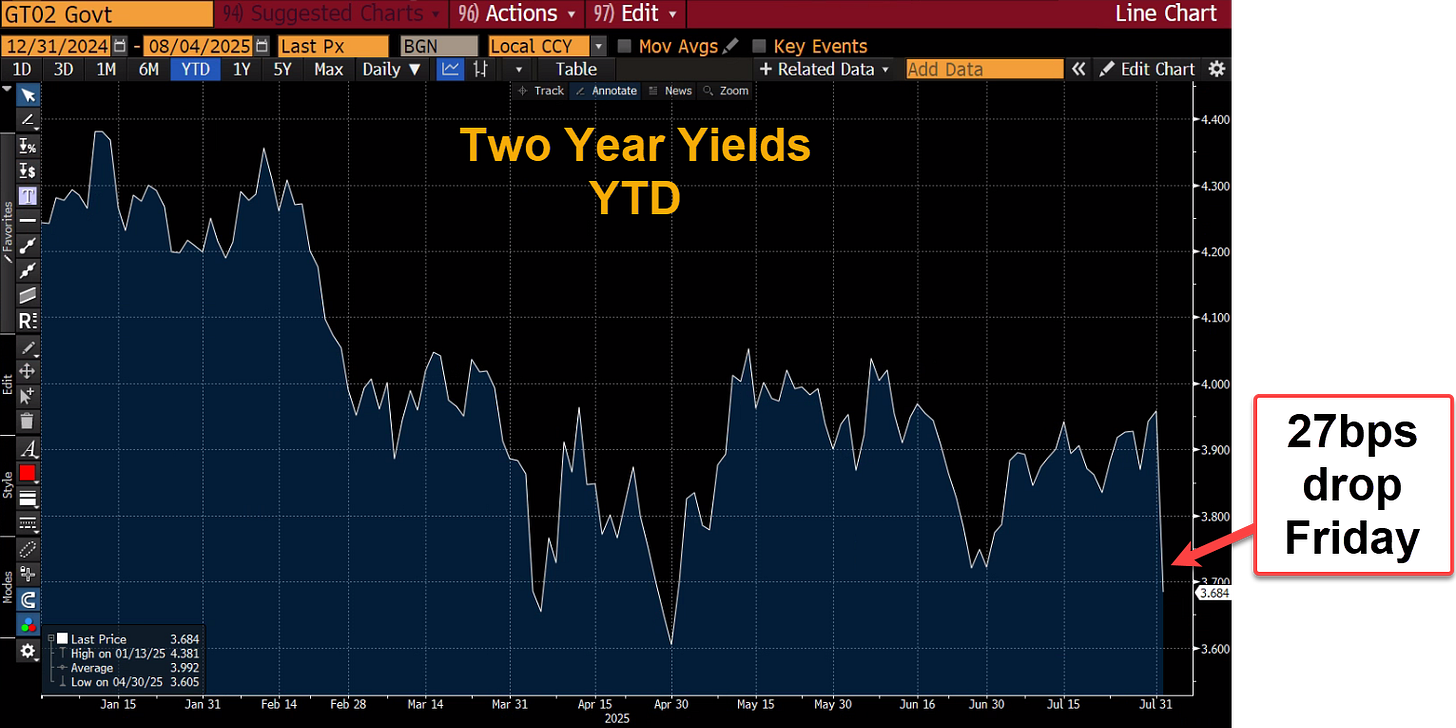

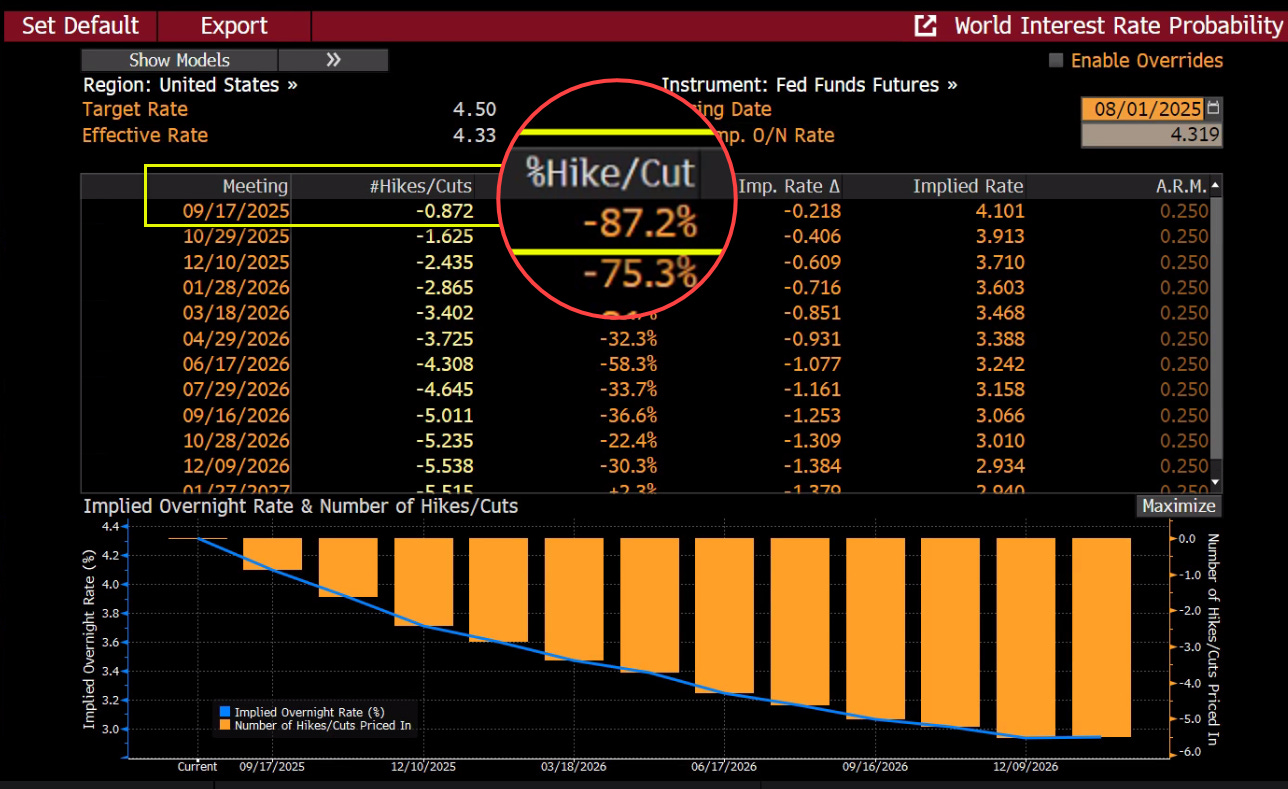

Lost in the noise was a subtle, but telling shift: two Fed Governors dissented for the first time in years. Bowman and Waller signaled growing concern that the Fed is behind the curve dissenting on last week's decision to leave rates on hold.

Bloomberg Data

Fed fund futures quickly all but erased any hope of a Fed cut in September. Less than 48 hours later a weaker than expected jobs report along with a massive revision lower of previous data cratered two year yields completely flipping the narrative on September which now looks like an 87% probability of a Fed Funds cut of at least 25 basis points.

Bloomberg Data

In the weeks ahead, the focus will shift from earnings to policy, from CapEx to clarity. But the through-line remains the same: In this data-driven world, garbage in still means garbage out.

David Nelson is the Chief Strategist of Belpointe Asset Management and host of The Money Runner Podcast

Disclosure: "At the time of this article I currently hold shares in some of the companies mentioned as part of investment portfolios in funds I manage for Belpointe. I went long Tesla shortly before this article was released. Additionally, I may discuss other securities that are under consideration for future investment; however, discussing these securities is not a recommendation to buy, sell, or hold. My mention of these securities reflects my personal opinion and analysis at this moment and may change without notice. Please remember that all investments involve risks, including the possible loss of principal."